ETH Price Prediction: Path to $5,000 Supported by Technical and Fundamental Strength

#ETH

- Technical Momentum: Bullish MACD crossover and Bollinger Band positioning suggest upward price pressure toward $4,800-$4,900 resistance levels

- Fundamental Strength: $30B in liquid restaking, institutional adoption, and ecosystem expansion provide strong foundation for price appreciation

- Market Sentiment: Positive developments from Ethereum Foundation and analyst projections up to $15,000 create optimistic market psychology

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Resistance

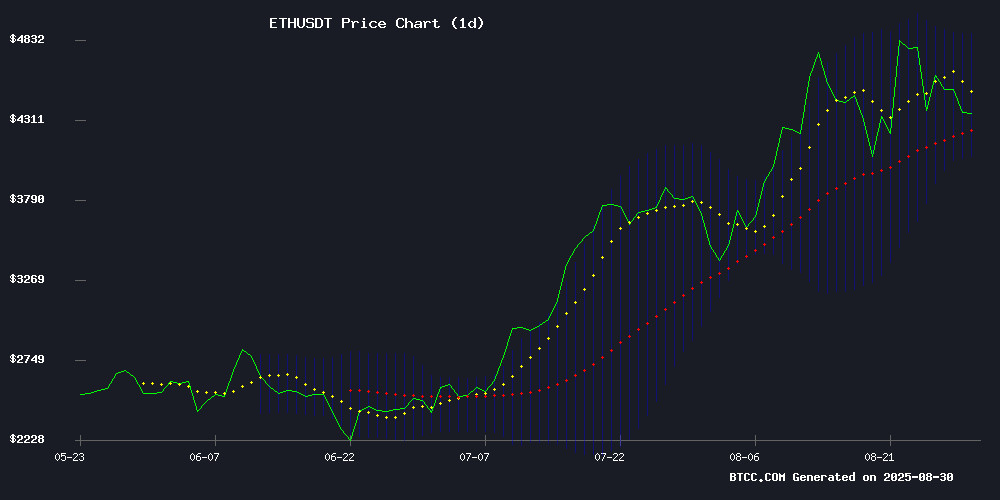

ETH is currently trading at $4,396.35, positioned below the 20-day moving average of $4,476.78, indicating potential short-term resistance. The MACD indicator reveals a bullish crossover with the histogram at +135.49, suggesting growing upward momentum. Bollinger Bands show price trading NEAR the middle band with upper resistance at $4,873.88, providing a clear technical target for bullish突破.

According to BTCC financial analyst Mia: 'The technical setup suggests ETH is consolidating before a potential upward move. The MACD bullish crossover and position within the Bollinger Bands indicate building momentum toward the $4,800-$4,900 resistance zone.'

Market Sentiment: Strong Fundamentals Support ETH's Ascent

Ethereum's ecosystem developments are creating strong bullish sentiment. The ethereum Foundation's focus on interoperability and strategic refocusing, combined with Remittix's $22M raise and liquid restaking reaching $30 billion, demonstrates robust institutional and validator confidence. Fundstrat's $15,000 price projection by 2025 and record blockchain transfer volumes further support the optimistic outlook.

BTCC financial analyst Mia notes: 'The convergence of technical indicators with fundamental developments creates a compelling case for ETH's continued growth. The ecosystem's expansion into gaming and institutional adoption provides strong tailwinds for price appreciation.'

Factors Influencing ETH's Price

Ethereum Foundation Prioritizes Interoperability to Enhance User Experience

The Ethereum Foundation has unveiled a strategic shift in focus, targeting interoperability as the cornerstone of user experience improvements across its Layer-2 ecosystem. A new blog post outlines plans for an Ethereum Interoperability Layer (EIL), designed to streamline cross-chain interactions with a trustless messaging system.

Developers aim to make Ethereum's fragmented Layer-2 landscape operate as seamlessly as a single chain. The initiative builds on previous scaling achievements, now prioritizing speed, finality, and unified operations. A public design document for EIL is expected in October, potentially setting new standards for cross-rollup communication.

Ethereum Foundation Pauses Grants Program to Refocus Ecosystem Strategy

The Ethereum Foundation has suspended its Ecosystem Support Program (ESP) to overhaul its grantmaking approach, shifting from an open-application model to a curated, strategic funding system. This decision follows years of distributing millions in grants—$3 million across 105 projects in 2024 alone—amid operational strain from high submission volumes and a lean team.

The pause halts new applications but maintains non-financial support for existing grantees. Focus now turns to targeted investments in scalability and network interoperability, signaling a prioritization of long-term ecosystem resilience over broad but diluted funding.

Ethereum Nears Critical Breakout as Remittix Gains Momentum with $22M Raise

Ethereum's price action suggests a potential surge toward $5,000, with technical indicators reinforcing bullish sentiment. The cryptocurrency has maintained stability around $4,600, outperforming peers like Bitcoin and Solana. A decisive move above $4,800 could pave the way for new all-time highs, though downside risks remain if support at $4,200 fails.

Meanwhile, Remittix dominates altcoin discussions after raising $22 million through token sales priced at $0.0987 each. Its upcoming centralized exchange listing has analysts labeling it a top DeFi project to watch in 2025. The 626 million tokens sold underscore robust demand for innovative blockchain solutions.

Ethereum Liquid Restaking Surges to $30 Billion as Validators Shift Strategies

Ethereum's liquid restaking protocols have reached a staggering $30 billion in total value locked, signaling a major shift in validator behavior. Validators are increasingly withdrawing from native staking to pursue higher-yielding opportunities in decentralized finance.

Market leaders like EtherFi and Eigenpie are capturing significant share as capital reallocation—rather than exit—drives this trend. The move reflects growing sophistication in Ethereum's ecosystem, where participants now demand both staking rewards and DeFi flexibility.

Liquid restaking innovations enable derivative tokenization of staked ETH, preserving exposure to base rewards while unlocking liquidity for yield aggregation. This dual-benefit approach is reshaping Ethereum's staking economy as protocols compete to offer the most efficient capital deployment strategies.

SEC Delays Decision on Grayscale's Ethereum ETF Staking Proposal

The U.S. Securities and Exchange Commission has postponed its ruling on Grayscale Investments' bid to incorporate a staking feature into its Ethereum Trust ETF. The move underscores regulatory hesitancy as Ethereum's proof-of-stake model gains traction among institutional investors.

Approval would mark a watershed moment for crypto ETFs, enabling passive income generation through staking rewards—a feature increasingly demanded in yield-starved markets. Grayscale's persistence comes despite previous setbacks, including the SEC's rejection of its Bitcoin Trust conversion.

Market participants view this as a litmus test for how regulators will treat proof-of-stake assets. The decision could either catalyze broader ETF adoption or reinforce the regulatory chokehold on innovative financial products.

Pudgy Penguins Expands Into Mobile Gaming With Launch of ‘Pudgy Party’ on iOS and Android

Pudgy Penguins, the Ethereum-based NFT brand, has partnered with Mythical Games to launch Pudgy Party, a mobile party game now available globally on iOS and Android. The game, reminiscent of Fall Guys, features fast-paced mini-games and characters from the Pudgy Penguins collection, each with unique traits and abilities.

The launch marks Pudgy Penguins' foray into gaming, potentially boosting the value of its PENGU token. CEO Luca Netz emphasized the brand's focus on connection and joy, aiming to create accessible experiences for a global audience. Players can collect outfits and emotes, adding a layer of customization to the gameplay.

Ethereum Price Predictions and Market Sentiment

Ethereum's bullish momentum faces a critical test as it approaches the $4,945 resistance level, a threshold last seen during its 2021 peak. Despite strong ETF inflows and institutional interest, ETH has struggled to breach this barrier, with some traders anticipating a pullback to $4,500.

Analysts remain divided on Ethereum's near-term trajectory. Standard Chartered projects a year-end target of $7,500, citing ETF demand and regulatory clarity from the Genius Act. Longer-term forecasts suggest ETH could reach $7,000-$12,000 by 2026, contingent on successful network upgrades and adoption.

Meanwhile, altcoins like Remittix are gaining attention as alternatives. Market participants are increasingly evaluating utility-driven projects amid Ethereum's consolidation phase.

Top Altcoin to Invest in: Why This Meme-to-Earn Token Could Outperform Ethereum (ETH) in Q4

Ethereum (ETH) continues to dominate as the backbone of decentralized finance, holding steady above $4,500. Its resilience in volatile markets cements its status as a blue-chip asset, yet analysts question its near-term growth potential.

With scaling solutions and Layer-2 integrations largely priced in, ETH's upside appears limited compared to earlier cycles. Investors are now scouting for high-growth altcoins that could deliver exponential returns in Q4 2025.

Retail interest is shifting toward projects blending hype, affordability, and utility—smaller market cap tokens historically outperform established giants during bull runs. This trend underscores the search for the next breakout candidate.

Ethereum Breaks Records as Blockchain Transfer Volume Soars

Ethereum's blockchain transfer volume has surged past $320 billion this month, marking its highest level since May 2021 and the third-largest monthly volume in history. The rally is fueled by institutional acquisitions, ETF demand, and network upgrades.

Institutional ETH reserves skyrocketed from $4 billion to over $12 billion in August, driven by major purchases from firms like BitMine Immersion and SharpLink Gaming. Spot Ethereum ETFs now hold more than 5% of the total supply, signaling strong institutional confidence.

Transaction counts and active addresses hit near-record highs, supported by low fees and scalability improvements. The momentum reflects Ethereum's growing dominance as a foundational layer for decentralized finance and institutional crypto adoption.

Ethereum Nears All-Time High as Fundstrat's Tom Lee Projects $15,000 Target by 2025

Ether trades at $4,783, flirting with record levels as institutional demand fuels its upward trajectory. Fundstrat's Tom Lee doubles down on his $15,000 year-end forecast, citing Ethereum's dominance in DeFi and real-world asset tokenization.

The SEC's review of staking-enabled ETH ETFs could mark a watershed moment for U.S. crypto products. BitMine Immersion Technologies' $7.3 billion treasury position underscores growing corporate adoption.

Investors face three clear paths: direct ownership, spot ETFs, or exposure through treasury-holding corporations. Market momentum suggests Ethereum's infrastructure play is only beginning to mature.

Will ETH Price Hit 5000?

Based on current technical indicators and fundamental developments, ETH has a strong probability of reaching $5,000 in the near to medium term. The current price of $4,396.35 needs to overcome the 20-day MA resistance at $4,476.78, with the next major resistance at the Bollinger Band upper level of $4,873.88.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,396.35 | Support level |

| 20-day MA | 4,476.78 | Immediate resistance |

| Bollinger Upper | 4,873.88 | Next resistance |

| Target | 5,000.00 | Psychological barrier |

BTCC financial analyst Mia emphasizes: 'The combination of bullish MACD momentum, strong institutional developments, and ecosystem growth creates favorable conditions for ETH to test the $5,000 level. However, traders should monitor the $4,476 resistance break for confirmation of upward momentum.'